Responsible AI: What Canadians Want in Banking

by Amber Mac on September 12, 2019

There is a lot of talk these days about the responsible implementation of artificial intelligence technology. Businesses across all industries are working hard to figure out how to reap the benefits of AI while identifying the inherent risks of automation. In the financial services industry, this is especially true. Many consumers don’t understand what exactly AI means for their banking experience, and they need more expert dialogue on this topic.

To kickstart this conversation, TD just released a new report called “Responsible AI in Financial Services”. Their team brought together AI experts from a number of different disciplines, including Jodie Wallis (my co-host on The AI Effect), to better articulate both AI opportunities and risks.

A survey of Canadians released in the report sheds some light on where Canadians are in terms of: Awareness, Innovation, Concerns, and Expectations. While I don’t want to give away the entire report, here are some highlights they found.

- 72% of Canadians are comfortable with AI if it means they will receive personalized services

- 87% say they want banks to be innovative

- 77% are concerned that AI is advancing too quickly to really understand potential risks

- 28% say decisions made using AI should be easy to explain and understand

It is this last point that inspired the roundtable of experts to identify the first of three areas of focus: Explainability. Explainability means determining “how AI experts and business leaders should approach the inherent limitations of the technology as it relates to explaining how AI models arrive at conclusions”.

To read about the other two areas of focus, and more on responsible AI in financial services, download the entire report now for free.

Responsible AI in Financial Services #Sponsored https://t.co/koGRhozotU

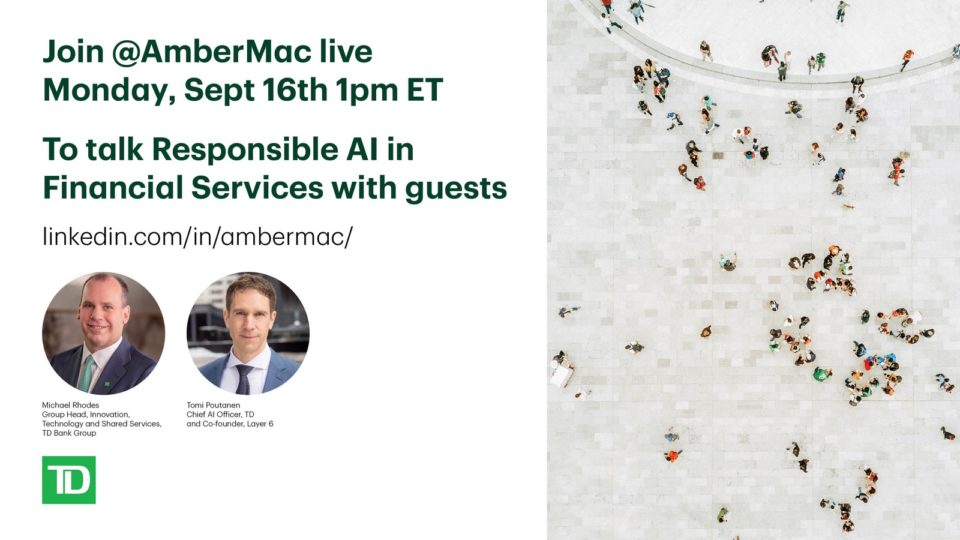

— amber mac (@ambermac) September 16, 2019

#SponsoredByTD